Small Steps: Update Your KiwiSaver Contact Details

Keeping your financial life in order doesn’t always require a complete overhaul. Sometimes, it’s the small, simple actions that make the biggest difference. That’s the idea behind our Small Steps blog series—breaking down financial housekeeping into quick wins that take minutes, not hours.

This month’s tip? Update your contact details with your KiwiSaver provider. It may sound minor, but it can have a big impact on your future.

Why bother updating your KiwiSaver details?

It’s easy to view KiwiSaver as a “set and forget” investment—especially once you’ve used it to buy your first home. But even if you’re not checking your balance regularly, it’s still important to receive communications from your provider. Why? Because each year, there are a couple of key details that need to be reviewed:

Your Prescribed Investor Rate (PIR): This is the tax rate applied to the returns on your KiwiSaver investments. If it’s too high, you’ll overpay tax. If it’s too low, you may end up with an IRD bill later on.

Your Member Tax Credit (MTC): The government contributes up to $521.43 per year to your KiwiSaver, provided you’ve contributed at least $1,042.86 yourself. If your details are out of date, you might not even know whether you’ve qualified.

To confirm these details and make any corrections, you need to receive your annual KiwiSaver statement—and that only happens if your contact info is up to date.

There’s also a more sobering reason to keep your information current. If you were to pass away, having accurate contact details on record makes managing your estate significantly easier for your loved ones. It’s not something anyone likes to think about, but being prepared is a gift to your future self—and your family.

But what if I don’t know who my provider is?

If you’re unsure who your KiwiSaver provider is, you’re not alone. It’s estimated that around 40% of New Zealanders don’t know where their KiwiSaver funds are held. That’s largely due to New Zealand’s auto-enrolment scheme. When you start your first salaried job, you’re automatically enrolled into one of the government’s default providers unless you actively choose a different one.

You might have received a welcome letter at the time—but if you’ve since moved house or changed your email, you could be missing important updates.

How to find your provider:

Log in to myIR – Your KiwiSaver provider should be listed in your IRD online account.

Call Inland Revenue – If you don’t have access to your online account, the IRD can confirm your provider over the phone (you’ll need to verify your identity).

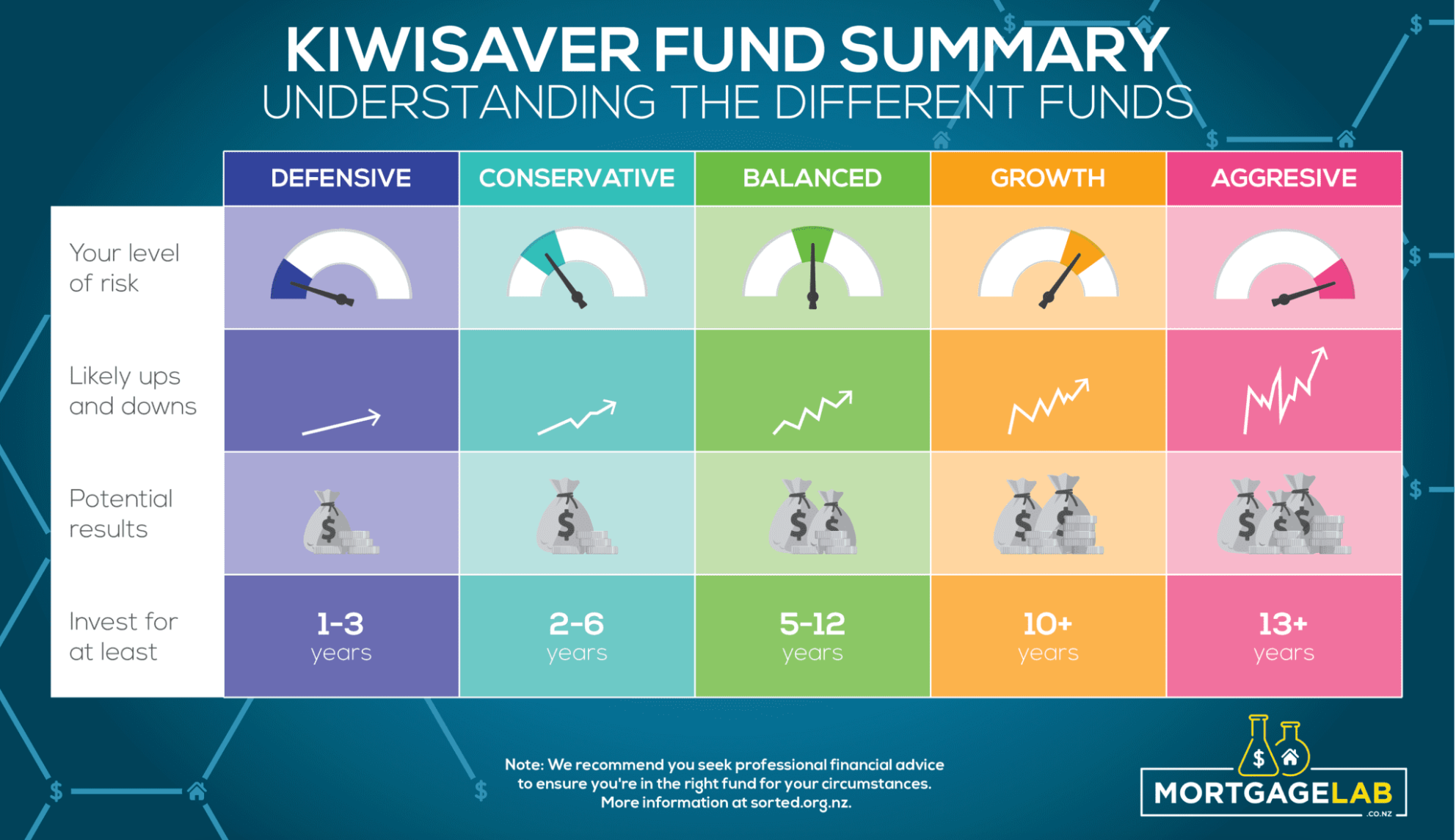

Reassess your options – If you don’t like what you find, remember you’re free to switch providers. Choosing a fund that aligns with your goals—whether that’s ethical investing, higher growth, or lower fees—could make a significant difference to your long-term savings.

How to update your contact details

If you do know your KiwiSaver provider, the process is simple:

Contact your provider directly – You can usually update your details online, by email, or over the phone.

Be ready with proof of ID and address – This might include a recent bank statement or utility bill, and your KiwiSaver account number.

While you’re at it, it’s worth checking your PIR and making sure your contributions for the year are on track to earn the full Member Tax Credit. Most providers allow you to view and update this information online.

One small step, one big win

It’s easy to overlook the admin tasks when it comes to long-term investments like KiwiSaver. But keeping your contact details current ensures you’re not missing out on valuable updates, tax credits, or the chance to correct errors.

Even better? Once you’ve updated your info, you’ll likely receive a fresh statement and a sense of calm knowing your KiwiSaver is still working for you—quietly and steadily in the background.

Mortgage Lab’s mission is to be the digital town square for financial decision-makers to gain knowledge about their current and future mortgage. Follow us on Facebook and LinkedIn or subscribe to our newsletter to be notified of our latest articles.